- Philippine Science HS Graduate

- DLSG BSAE F/MCT Undergraduate

- 3 years exp. in Financial Market

- 5 years experience in organizing

Excelon Capital is a fund management partnership wherein investors can earn higher than benchmark returns without the hassle of due diligence and analysis. We pride ourselves with our high historical returns and our capacity to give investors a fire and forget, hassle-free investing experience

consists of: 12 analysts | 3 relations officer | 2 accountants | 2 compliance officers | and a graphic designer

Over the last three years, our Chief investments Officer had averaged 20% annual returns through long-term stock positions in the market. We firmly believe that time in the market beats timing the market.

Margin from

Competitors

In the last 3 years

Investment Outperformance vs. Benchmark

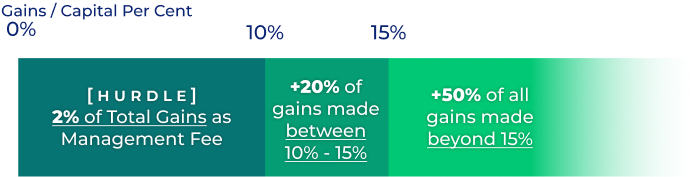

The managing partners shall take 2% of the year-end equity from investing partners as management fee to cover the business' expense. A hurdle, which shall serve as a target and below which the managing partners may not take bonuses is to be set at 10%. However once this is exceeded, the managing partners shall take 20% of all gains made from 10% to 15% and 50% of all gains made beyond 15%.